Tax Projection Calculator

In order to calculate the Seaford School Tax, you will need the Assessment Value information from Sussex County. Assessment Value is NOT the same as market or property value. The Assessment Value for Sussex County is reflective of 1974 replacement cost values. For questions about assessment values, call the Sussex County Office of Assessment at (302)-855-7824.

Tax rates are estimates based on several factors including interest rates, bonds with twenty year maturity, assessed value of district and assessment to sales ration. Any or all of these estimates could change resulting in alterations to the tax rate. Cost figures are rounded to two decimal places during calculation.

Step-by-Step Video Instructions

Step-by-Step Written Instructions (with screen shots)

- In order to calculate the Seaford School Tax, you will need the Assessment Value information from Sussex County.

- If you already have this information - Click the following link to go directly to the Calculator Page.

- If you need this information - Complete the following steps to obtain the assessment value.

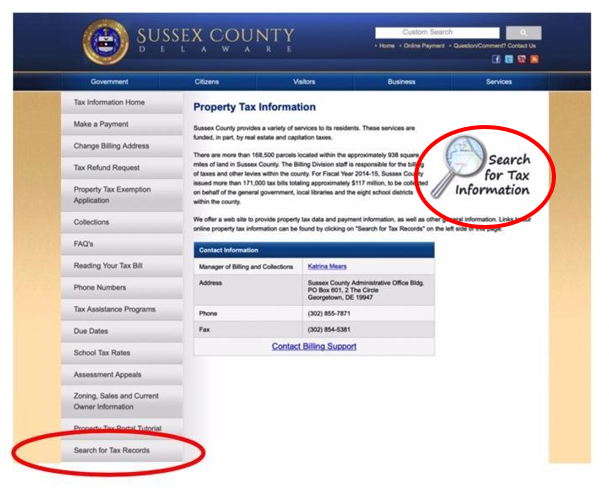

Scroll down on the left and click on either the "Search for Tax Information" or the “Search for Tax Records” option as indicated below.

Step 2:

On the Real Estate page, enter either the Owner's Name or the Parcel ID to search for the tax information.

Step 3:

As a result of the search, a listing of the potential Tax Records with the address associated will appear as pictured below. Identify the specific property address for your inquiry. Then click “View Bill” on the right of the appropriate Tax Record.

Step 4:

Now click the “View bill image” to see the tax bill.